Veteran Owned Tax Firm.

Focused on IRS and State Controversy.

Since 2002, The Tax Defenders has been a premier name in tax solutions. Whether you are an individual, or a business owner, our experienced and dedicated team at The Tax Defenders is ready to diligently secure solutions on your behalf.

A Company Founded From A Personal Tax Issue

While working at a homeless shelter and seven years before starting TTD, Joe (the owner) made a withholding error. What was a small liability debt ballooned into owing the IRS just over $10,000. It took him four years to pay that off. It was a tough financial chapter but infuses our practice with a great deal of empathy for people fighting through tax problems.

The company was formed in 2002 as it became clearer to Joe about how difficult it was for people to solve their issue with the IRS. Two decades later, he is still deeply involved in helping clients resolve their issue with the IRS.

Joe is a veteran of five years of service in the United States Marine Corps including combat in Desert Shield/Desert Storm. We get our no-hype, straight-talk as well as our sense of duty from the Marines.

A Company Founded From A Personal Tax Issue

While working at a homeless shelter and seven years before starting TTD, Joe (the owner) made a withholding error. What was a small liability debt ballooned into owing the IRS just over $10,000. It took him four years to pay that off. It was a tough financial chapter but infuses our practice with a great deal of empathy for people fighting through tax problems.

The company was formed in 2002 as it became clearer to Joe about how difficult it was for people to solve their issue with the IRS. Two decades later, he is still deeply involved in helping clients resolve their issue with the IRS.

Joe is a veteran of five years of service in the United States Marine Corps including combat in Desert Shield/Desert Storm. We get our no-hype, straight-talk as well as our sense of duty from the Marines.

Why our clients use us

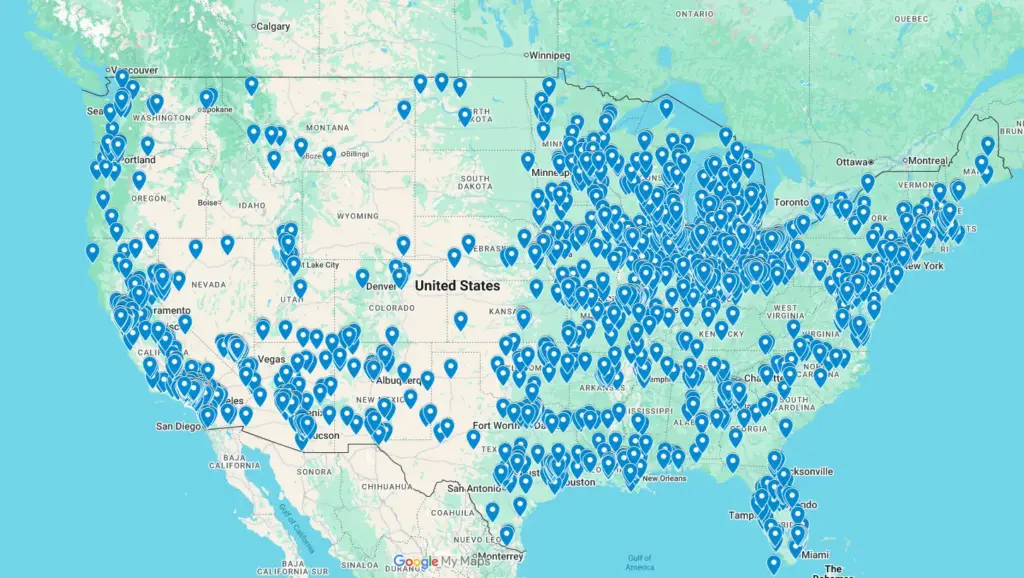

Founded in Chicago, We Practice Nationwide

The tactics the IRS use may have changed since we started. Read below some major changes through our time.

2006: Settlements became harder.

Congress made Offers in Compromise harder. Suddenly taxpayers needed 20% down, nonrefundable, just to apply. Installment offers required payments while the IRS decided which could take two years.

2006–2009: The first private debt collectors.

The IRS outsourced old debts to private agencies. It failed. Too expensive, too inefficient. But it signaled where things were heading.

2011: Fresh Start opened new doors.

The IRS overhauled its settlement program to help taxpayers struggling after the recession. They made it easier to qualify for installment agreements. We helped more clients settle their debt in the years that followed than ever before.

2015: They started taking passports.

Congress gave the IRS power to revoke or deny passports for anyone who owes more than $50,000. International travel became leverage.

2017–Present: Private debt collectors returned.

Congress brought them back. By 2018, over $5.7 billion in debt from more than 600,000 taxpayers had been handed off to third parties.

2020–Present: Everything went automated.

E-filing hit 90%. The IRS started using automated systems to match W-2s and 1099s, issue levy notices, and build cases without a single human involved.

2020–2023: COVID relief. Then the clawbacks.

The IRS paused collections. Then PPP loans and Employee Retention Credits went out by the billions. Business owners were told they qualified when they didn’t. Now the IRS is auditing, assessing penalties, and demanding it all back.

2022–2026: Historic funding. Then cuts. Then chaos.

The IRS got $80 billion to modernize and hire 87,000 new employees. By 2026, over $21 billion has been rescinded. But don’t mistake budget fights for a softer IRS. They’re prioritizing high-dollar cases and letting automation handle the rest.

What’s your goal today?

Considering hiring us?

Click below to read about our team, our process and why we think we are pretty great.

Learn more about your tax problem

Want to read higher level information about your problem and how to fix it.

Have a specific question?

Well, websites aren’t that great at understanding specific problems. Click below and a real person will review and answer your question.